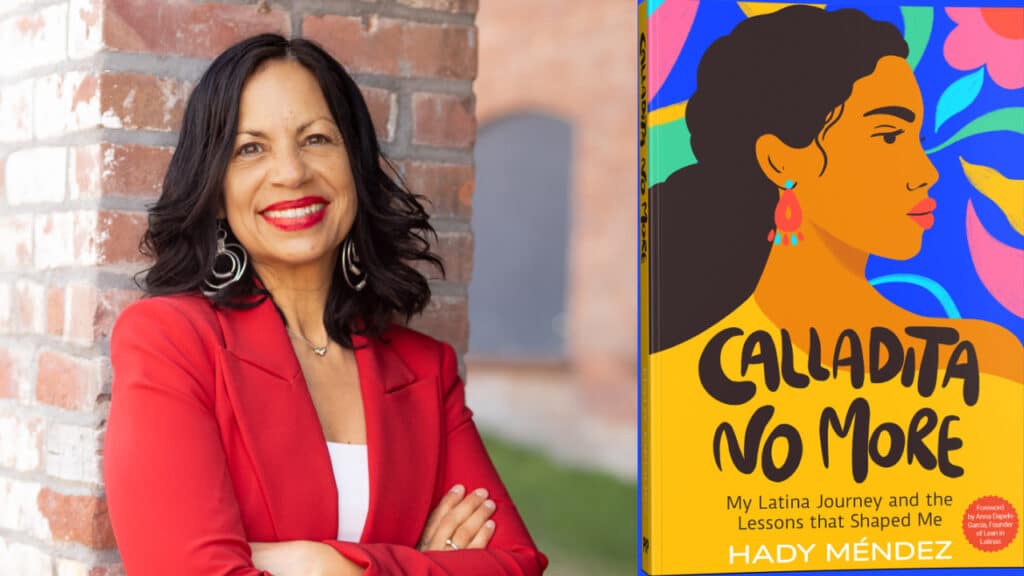

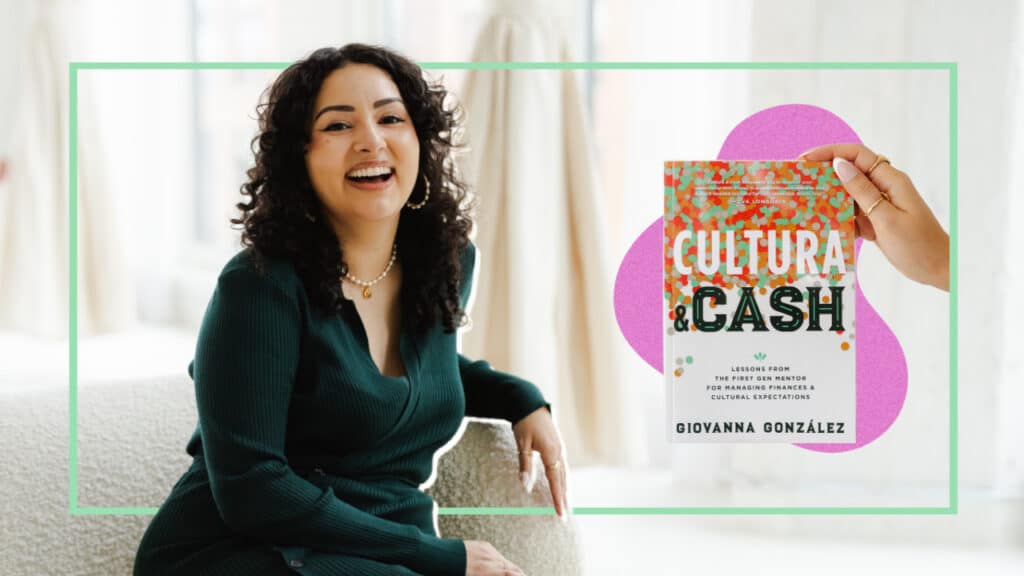

Cultura & Cash: Giovanna Gonzalez Guides First-Gen Latinas to Financial Empowerment

The experience of being a first-generation Latino is unique and unparalleled. The traumas and struggles are particular, to the point that first-gen Latinos have bonded in social media, often sharing those experiences that are so intrinsic to them.

Often being the eldest child, Latino first-gen share the trauma of putting their needs on the back burner and of being the ones on whom immigrant parents depend for almost everything.

And no wonder. For the experience of being the one at the helm of a family, navigating the American experience for the first time is no simple matter. The consequences, in turn, are long-lasting.

From stressors to traumas, first-generation Latinos definitely have a lot to endure. However, one of this generation’s most persistent struggles is the financial burden and the difficulty of keeping their heads above water.

That’s why we spoke with financial educator and author Giovanna Gonzalez, aka The First Gen Mentor, about how Latinas can break through generational traumas and empower themselves to feel more confident managing their money and thrive financially.

Here, we share a small part of the infinite wisdom of this Jefa, badass educator and author.

Understanding the financial needs of first-gen Latinas

As the proud daughter of Mexican immigrants, Giovanna Gonzalez knows a thing or two about what it means to be first-gen Latina.

The Chicago-based financial educator knows firsthand the unique challenges first-generation Latinos experience on the journey to wealth creation.

“Most of us never learned any financial education at home because our parents lived in survival mode as immigrants in a new country,” she told FIERCE. “We don’t get to benefit from the transfer of generational wealth like some of our more privileged peers, so we often start adulthood with significant student loan debt and no financial safety net.”

Gonzalez explains that, as daughters of immigrants, first-generation Latinas have additional financial obligations to help extended family members.

Considering that Latinas have the second longest life expectancy, this implies that “we need to have our money last longer.” Add to this the wage disparity, and it seems like a David vs. Goliath struggle.

However, for Gonzalez, there are tools to break this cycle.

The first step is to go beyond the budget

Many of us approach our personal finances from a fear of poverty. As Gonzalez explained, traditional personal finance only teaches you to take this first step: build an emergency fund, pay off debt, and navigate credit in hopes of investing for retirement.

However, our limited financial education ignores first-gen Latinas’ additional financial obligations to their respective families.

In her recently published book, “Cultura & Cash,” Gonzalez teaches us a different approach, but always with family in mind.

“That means that if you feel like you’re your parent’s retirement plan, you should create a plan for how you will financially support them in their golden years,” Gonzalez explains. “Or if you regularly get approached to cover financial emergencies, you should set a separate emergency fund for family emergencies to avoid tapping into your personal savings.”

It’s time to understand that family is not a burden but a support

Gonzalez recognizes that Latinas are very family-oriented, and that extends to our finances.

For budgeting, this financial educator adds family support as a “line item.”

“For example, I used to give my grandma a monthly allowance but never accounted for it in my budget,” Gonzalez told us about her personal experience. “I started adding this monthly support as a line item in my budget to help me get a clear picture of my spending.”

Considering Gonzalez also plans to financially support her dad with medical costs when he’s retired, she advises other first-gen Latinas to have an investment account set aside. “I’m adding small amounts of money to have it available when he needs it,” she explains.

The importance of breaking generational curses

For Gonzalez, who focuses on educating first-gen Latinas and other women of color to learn how money works in simple terms — that is, without the finance bro jargon — we must understand that breaking generational curses means “moving differently than your family did.”

In her book “Culture & Cash,” Gonzalez devotes an entire section to what she calls “Immigrant money habits that keep us broke.”

The financial educator acknowledges systemic problems that keep our community in the cycle of poverty.

“We can’t blame individuals for systemic oppression,” she clarifies. However, Gonzalez also believes it is fair to reflect on the habits we practice as part of “what we do” as Latinas.

For example, Gonzalez explores how we are known for throwing elaborate parties.

“We spare no expense and even get ourselves into debt for these parties,” she explains, “Do over-the-top bautizos, piñatas, or quienceañeras ring a bell? Now, of course, it’s important to celebrate big milestones with family, but it can’t be at the expense of our financial well-being.”

“I believe we’re better off having a smaller and more budget-friendly event that still allows us to create memories with those we love without derailing our financial future.”

Enter the ‘Quiero y Puedo Approach’

Like many other first-gen Latinas, Gonzalez spent part of her 20s struggling to juggle her high debt load, her entry-level salary, and her family’s high expectations.

After years of practice, she developed a method that allows her to balance financial support for her family without getting in her way.

Gonzalez calls it the “Quiero y Puedo Approach,” and she shared it with us:

First, ask yourself, ¿quieres? Do you want to help? Because if you’re not born and you’re not doing it out of your own free will, it won’t feel good to give money. You’ll eventually start feeling resentful.

Next, ask yourself, can you? Can you financially afford it? Do you have savings of your own, or are you living paycheck to paycheck? If you don’t have financial stability yourself, you must learn to get comfortable saying “no” or “not right now.”

“You can show up for family in other ways,” she adds. “You can help with your time, share knowledge, point them to resources, or offer emotional support. Remember, boundaries are not selfish, and you have the autonomy to decide how to use your money.”

It’s time to put ourselves first

The dream of every first-gen Latina is to achieve financial independence and stability while successfully navigating cultural expectations.

According to Gonzalez, the first thing to achieve this is to learn to “prioritize your finances before heavily supporting others.”

“Marianismo is prevalent in our culture, making Latinas feel like we have to self-sacrifice for everyone else,” she explained. “But just like they tell you on airplanes, you must put your oxygen mask first before you help others.”

“It is not selfish to prioritize your finances. It’s smart and will help you build a solid financial foundation. And when it is time to help the family out, you’ll do it knowing you have the financial means to.”

Throwing the term ’emergency fund’ out the window

For Gonzalez, words have a lot of power. That’s why perpetuating the idea of the “emergency fund” is a thing of the past. The financial educator encourages first-gen Latinas to ditch the term and change it “to something that feels safer and more empowering.”

“The word ’emergency’ doesn’t necessarily feel good, so instead, I like to call it my ‘peace of mind fund.’ Others call it ‘my safety net fund.’ Pick a name that sparks action for you,” she recommends.

Once we’ve committed to building that savings fund, Gonzalez recommends keeping the savings in a bank or credit union different from where we have the checking account.

“When both the accounts live at the same institution, it can be easy to dip into savings when overspending, so having it at a different bank creates a barrier that will help you accumulate money over time.”

Next, the ideal is to look for ways to earn extra money or cut expenses, so you have more money to put into savings.

From this moment on, Gonzalez stresses the importance of patience.

“Building a peace of mind fund can take months, even years! Mine took almost two years,” she says. “Stay committed to your goal. With consistent progress, you’ll soon get to benefit from the financial peace that comes with having savings that are there for you when you need them.”

It’s time to break the money taboo in our Latino families

For Gonzalez, first-gen Latinas must have regular and transparent conversations about money with their families.

Knowing that money can be taboo in our culture, Gonzalez insists that it is essential to understand that we may experience some resistance at first, but we must not give up.

“Let your family know you’re mapping out your financial future, and you want to do it with them in mind because you love them,” she says. “Ask them what type of financial support they need now or anticipate needing in the future. Ask them how they plan to cover expenses during retirement. And then be real about what type of support you’re able to provide to help cover the gap. The more you practice money conversations with them, the easier it will get!”

Finally, Gonzalez recommends taking advantage of the free access to financial education that the Internet offers us. From podcasts and YouTube videos to personal finance books written by and for Latinas and BIPOCs like “Cultura & Cash,” our money transformation is at our fingertips.

“Sure, as first-gen Latinas, our road is tougher, but we’re smart, resourceful, resilient,” Gonzalez concludes. “We can do hard things. I’m cheering for your financial success!”